Welcome to the Block & Mortar newsletter! Every week, I bring you the top stories and my analysis on where business meets web3: blockchain, cryptocurrencies, NFTs, and metaverse. Brought to you by Q McCallum.

Reading online? Subscribe to get this in your inbox whenever it's published.

Do you hear that? I think it’s the sound of “web3 stories that have nothing to do with SBF.” Such is the effect of the verdict being behind us. I’m reading about inflated asset prices. The SEC weighing in on crypto projects. Corporate metaverse events. And even some mention of the Bored Ape Yacht Club (BAYC) NFT collection.

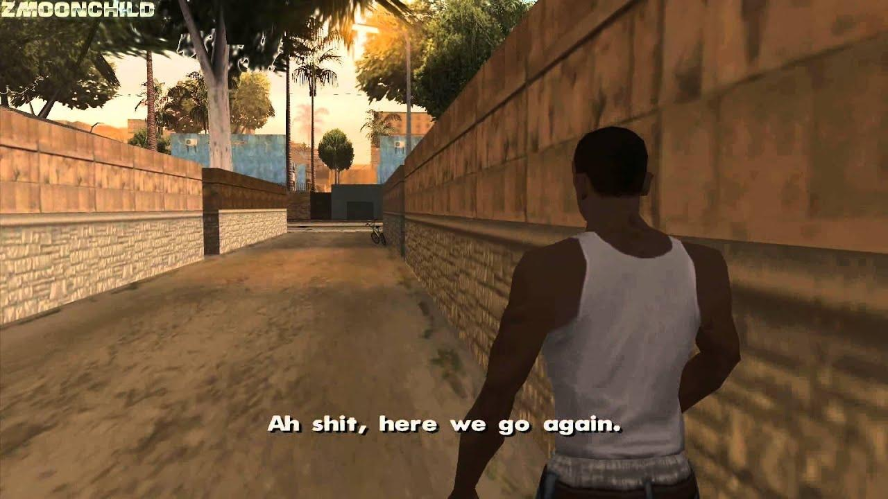

In some ways, it’s very much “We’re Back.”

In other ways, it’s “Here We Go Again.”

This first segment is the prime example:

Rock on, crypto

If I were to tell you that pet rock NFTs were selling for six figures, you would:

- Chide me for rerunning a newsletter from 2021.

- Smile as you remembered that great NFT sketch by Joma Tech. (Say it with me: “I like the rock.”)

- Remind yourself that this is, y’know, totally fine because asset prices reflect all relevant information in a rational market.

That last point means these aren’t just pet rock images. We’re clearly talking about NFTs With Benefits, right? So your next move would be to ask me what special access is granted to holders of these pet rock NFTs. And I’d have to (disap)point you to a Decrypt article that explains:

The JPEGs do not come with any affiliated memberships or perks, or anything that doesn’t meet the eye. They are, quite simply, lightly illustrated images of nearly indistinguishable gray boulders that don’t even feature backgrounds.

By this point, you’re shaking your fist at me. You’re asking me why this is happening. But we both know why. It’s because asset prices are based on collective belief. And because, once again, the belief is that “this time, it’s different.”

Even though it never, ever is.

Yep. Crypto is back, people.

(For now.)

Not the intended outcome

Last week was the third annual ApeFest, the gathering of Bored Ape Yacht Club fans. This time around parent company Yuga Labs ran the show out of Hong Kong, a venue that holds special significance since it is China’s designated space for crypto.

There was plenty to experience, from city-exploration games to BMW’s BAYC-themed “Ape Car.” ApeFest also included virtual activities for people who were attending from afar. For admission to the in-person event, Yuga Labs added a slight twist to pure token-gating:

Entry to ApeFest is free for all apes but is still limited to only BAYC and MAYC holders (and their plus ones) with a showing of a valid ticket via the tokenproof app. In efforts to preserve tickets for those apes who can attend IRL, the collective is implementing a refundable deposit that will be returned once a holder is scanned in.

Take note if you’re planning your own event for NFT holders. Small frictions, like this refundable deposit, can work wonders for spotting who is generally interested in attending.

And … that’s everything that worked according to plan. I wanted to mention all of that before I got to the unintended headline-grabber, which is that some attendees suffered vision problems because of the venue’s UV lighting.

Events are proving grounds for Murphy’s Law: audio malfunctions, last-minute speaker cancellations, late or incorrect food deliveries, communicable diseases (even in those halcyon days before The Thing That Keeps Hanging Around™) … You experience this tenfold if you’re in charge of the show, praying that the good parts wow people so much that they forget the bad parts.

But sometimes, it’s just not your lucky day. And your choice of lighting is all people write about.

All of that is to say: when I think of everything that can go wrong at an event, “eye damage from stage lights” was never on my bingo card. Yet, here we are. I understand that photokeratitis – unexpected vocab word of the week – often clears up in short order. Hopefully that holds true for the ApeFest attendees.

I also hope that Yuga Labs is able to recover from this. The company was already facing headwinds from crypto winter, and just last month they announced some layoffs. I wager this unintentionally-memorable experience will impact next year’s ApeFest attendance. (Not to mention insurance contracts and attendee waivers…)

Getting straight to the analysis

You’ve seen plenty of headlines about “data” over the last fifteen years or so: “data is magic,” “data is the new oil,” “data will transform your business,” all that jazz. Those success stories usually skip over the uncomfortable truth that the fun parts (fancy graphs, AI models) are only possible because of the less-fun parts (collection, cleaning, storage management). And did I mention? The less-fun parts are said to run about 80% of the project’s total effort.

Data scientists and machine learning engineers only begrudgingly take on the less-fun parts. They prefer to start with a clean dataset that’s easy to query, allowing them to get straight to the analysis. So when someone mentions a clean dataset that’s easy to query, people take note. The latest such example is that data for the Solana blockchain is now accessible through the Google Cloud Platform (GCP) tool BigQuery.

BigQuery, if you’re not a cloud computing aficionado, is a hosted database service in GCP designed for massive datasets. By importing Solana data into BigQuery, GCP makes lets blockchain researchers to dive right into the analysis work:

Anyone from developers to enterprises and individual users can query data from Solana to answer complex questions regarding transactions, NFT minting, wallet activities and more, the Solana Foundation said. Leveraging Google’s Bigtable distributed data storage service alongside BigQuery, the ecosystem can also provide access to archival data from the Solana network.

Solana joins Bitcoin, Ethereum, and other tokens to be the twentieth cryptocurrency supported by BigQuery. And since BigQuery ties into other elements of the GCP stack, end-users will be able to run all of this through Google Cloud’s data visualization and machine learning tools. (They’ll still pay for using those tools, mind you. But that’s a small price to pay compared to what it would take for them to collect, clean, store, and manage all of that blockchain data on their own.)

Learning from others

For every company that’s feeling its way through a metaverse setup, there are several more that are taking notes from the sidelines. I get why they’re cautious. They remember that the history of social media is littered with corporate blunders, everything from the more innocuous “how do you do, fellow kids” incidents to hijacked hashtags. These companies are in no hurry to repeat such mistakes with their web3 presence.

For that cautious, note-taking crowd, here are two more examples for your research:

Gucci: The Sandbox is home to Gucci Cosmos Land, which serves as a counterpart to a physical exhibit about the clothier’s history. (Notice: similar to ApeFest, this is a dual-track atoms-and-bits affair. Because why not offer both, if you’re now able?)

Digital visitors can engage with the brand through interactive, gamified exhibits, with the opportunity to adorn themselves with Gucci products:

Unlike the physical experience, the digital version lets all attendees wear Gucci — at least, as their avatars. The first 100 players to complete the quests will have the option to wear one of four runway designs, including a look from De Sarno’s debut show. Those who complete all the quests can also be entered to win SAND 100, The Sandbox’s virtual currency.

Marriott: The older Gen Z crowd is reaching their mid to late twenties, which means they have more disposable income to throw at travel. It makes sense, then, that Marriott’s Bonvoy loyalty program would break ground in Fortnite in order to reach them. Remember the old sales rule: you have to meet people where they are.

Bonvoy’s Fortnite games aren’t just entertainment. They serve to familiarize players with the hotel chain’s various offerings. They can see properties that match their budget today, and also get a taste of what awaits them as they slip into lifestyle creep move up in the world:

At the playful Moxy hotel, for example, players challenge each other with a prop hunt, having one player transform into items such as flamingos or bananas while the other player tries to expose their disguise—all while uncovering a disco, arcade games, and vibrant art along the way.

At the Westin, meanwhile, players flex their endurance via a race, hopping across yoga mats in the hotel’s indoor pool, navigating through the WestinWORKOUT fitness studio, and blazing past an indoor living wall, complete with Westin Run Concierges cheering them on. The futuristic W Hotel, meanwhile, invites players in to search for a code to unlock a labyrinth, challenging them to follow the music and find their way to a DJ performance on the iconic WET rooftop deck.

If you remember the old “show; don’t tell” sales adage, this metaverse experience is an exercise in “participate; don’t show.” Most people would barely glance at flashy photos of hotel features. But here, players actively explore the brands. That should jog their memory later as they plan a hotel booking: “Oh yeh, Westin hotels usually have a gym. I’ll snag that one.”

I was about to say that chain hotels are competing with short-term rental platforms for Gen Z’s money. But then I remembered that Airbnb has recently been outlawed in NYC (and I’d expect other cities to follow). Who knows, then? Maybe, in some popular destinations, hotel chains will go back to only competing with each other.

Next week

Next Thursday is Thanksgiving in America (immediately followed by the country’s other November holiday, Black Friday) which means US work productivity will drop off early in the week.

Between social gatherings and hellish travel, I figure most readers will only have time to skim their inbox. So I’ll keep that newsletter light. Probably a quick list of links.

Apologies in advance to anyone who was hoping for a long list of reading material in order to avoid making eye contact with relatives.

The wrap-up

This was an issue of Block & Mortar.

Who’s behind Block & Mortar? I'm Q McCallum. I've spent the past two decades in the emerging-tech space. And I'm very interested in web3 use cases.

Credit where it's due. Big thanks to Shane Glynn for reviewing early drafts. Any mistakes that remain are mine.

Reading this online? Or as a forward? Why not sign up? Get Block & Mortar news in your inbox, whenever it's published.

Privacy statement: I don’t share/rent/sell your personal info. Seriously.