Welcome to the Block & Mortar newsletter! Every week, I bring you the top stories and my analysis on where business meets web3: blockchain, cryptocurrencies, NFTs, and metaverse. Brought to you by Q McCallum.

Reading online? Subscribe to get this in your inbox whenever it's published.

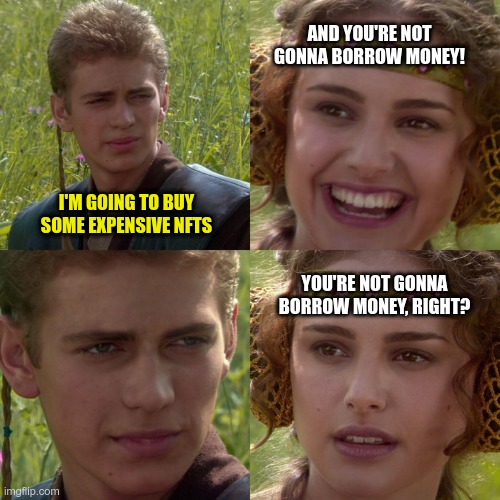

(Image credit: imgflip’s Anakin/Padme template.)

Subprimate loan crisis

(I can’t take credit for that title. I’ll explain in a moment.)

This segment was originally going to be about a guy who’d purchased a $6 million NFT. The Washington Post headline seemed to poke fun at the story so I’d planned to point out that, hey, these collectibles have value and utility beyond the price tag.

That was the plan. But then Things Happened™. So now this segment has warped into a periodic reminder about the wild world of variable-priced assets.

When you buy a house, a share of stock, or an NFT, you usually expect to profit when you eventually offload it to the next sucker buyer. This only works if prices have moved in your favor by the time you want to sell, though. So how do you avoid the pain of prices moving the wrong way?

1/ Do your homework. Extra research can help you avoid some of the bad investments. “This is only expensive because people like it? But fads come and go. How can I be sure this will still be hot by the time I want to trade it in for cash?” Hard pass.

2/ Only spend what you can afford to lose. You’ll be sad if prices move against you, but you won’t be too sad.

3a/ Use your own money. When you borrow money to buy the asset – that is, you “use leverage” or “lever up” – you’re placing a bet that you’ll sell it at a profit before the loan comes due. You get to hold the asset for the time being but your balance sheet is technically in the red till you sell. That’s not the kind of stress you want.

3b/ Do not use this asset as collateral for a(nother) loan. In the event you ignored 3a, and you also managed to score a loan that doesn’t use the asset as collateral, this is no time to get greedy. You don’t own an asset worth $X that you can pony up as collateral for something else; you carry a debt of close-to-$X while the lender lets you hold onto the thing.

You might remind me this list falls apart in the face of a mortgage, because you’re supposed to take out a loan to buy a house and the house itself serves as the collateral. But while the bank can reclaim the house if you don’t repay, they don’t want to be in the property-owning business. They’ll likely try to cut a deal with you so they can focus on the loan-managing business.

This is not the case with crypto. Everything is etched into a smart contract. The entire sequence of events relies on the simple if/then construct that computers handle all too well. Instead of several months of back-and-forth letters and haggling phone calls, your NFT asset is immediately seized by the creditor. “Liquidated,” in crypto-speak. No longer yours.

Why am I saying this now? Because, last week, prices of the Bored Ape Yacht Club (BAYC) NFT collection took a nosedive.

Plenty of people bought into BAYC because of the cool factor, so they were already at risk of a sudden price drop (point 1). That’s bad enough for anyone who’d paid for their NFTs outright (point 2). Those who borrowed money to buy the NFTs (point 3a) are now underwater on their loans – they can sell the asset at a massive loss but they’re still on the hook for the remainder of the original debt. And those who used their NFT as collateral on another loan (point 3b) just saw that asset liquidated.

All of which takes us to this segment’s title, courtesy @ChiefNoOfficer on Twitter:

Bored apes getting liquidated?

Sounds like a subprimate loan crisis.

Future vision?

A few weeks back I noted that the app ecosystem will make or break a hardware device. Most people don’t care about the underlying machinery; what matters is what they can do with the things.

Apple’s Vision Pro headset is no exception. Without those third-party apps, Vision Pro is just an expensive set of goggles. That’s why Apple is releasing Vision Pro’s software development kit (SDK) to app makers.

Apple is in an interesting position here. In many ways the Vision Pro is iPhone Part II. The company has fifteen years’ experience cultivating an app ecosystem on top of a device. That’s fifteen years of learning how to monetize the apps, developing guidelines for what apps will be allowed into the marketplace, and deciding what access those apps get to the end-users’ data.

That last point looms large. Longtime iPhone owners will no doubt remember the early, more trusting era of iOS. The days when apps would raid the device’s address book and location records. It wasn’t until 2008, under iOS 6, that Apple implemented stronger, fine-grained protections.

How much has Apple learned from its iPhone experience? And how many of those lessons will it apply to Vision Pro?

Loyalty Doesn’t Change

The speculative side of web3 is having a rough time these days but business use cases are quietly going strong. I mostly see this in loyalty programs, which have embraced blockchains to keep track of customer activity and use NFTs to reflect member achievements.

Are you considering a web3 approach to your loyalty program? Take some notes from these industry heavyweights:

First up, French clothier Lacoste has expanded its UNDW3 (pronounced “underwater”) loyalty program:

[Members] can participate in creative contests and interactive games with weekly mixed reality quests linked to the brand’s history and storytelling alongside fashion design challenges. The latter will run in close collaboration with Lacoste’s physical creative studio team, leveraging 3D and artificial intelligence based tools.

The more active, creative and efficient the community members, the more points they earn. The points are displayed on a leaderboard on the site.

And then we have Nike launching the “Airphoria” experience inside Fortnite:

[I]t’s a “sneaker hunt” wherein players move through a virtual world inspired by Air Max design codes. Five Air Max “Grails” (sneakers) — the Air Max 1 OG, Air Max 97, Air Max TW, Air Max Scorpion and Air Max Pulse — hover above the virtual world. Each Air Max Grail represents a key moment in the history of the sneaker.

Between these two efforts we see the pillars of successful loyalty programs: community, gamification, and interaction with the brand. They all build on each other to create a virtuous cycle of engagement.

Gamification sometimes gets a bad rap – and to be fair, for good reason – but done well, it’s a structured incentive system that can lead to mutual benefit. You give people a chance to meet goals (demonstrate achievements), they’ll share those achievements (develop recognition and social proof), and then they’ll see how they rank against others (bring out their competitive edge). All of this forms a feedback loop in which existing members increase their participation and new members are drawn in. As a bonus, people who aren’t interested in the brand will check out. So you’re left with a thousand true fans who will stick with you over the long haul.

Let’s keep in mind that this is not a distinctly web3 phenomenon. For an example that’s web0 (web-negative-one?), check out this recent Oreos promotion:

In addition to fan-favorite characters, the Super Mario cookies are also embossed with Power-Ups and Super Stars. Not each pack of Oreos contains all 16 cookies, though: Princess Peach — who recently received her own video-game announcement — is notably missing entirely from the collection, and Bowser is the rarest character to find, hinting that there may be trouble in the Mushroom Kingdom.

For anyone lucky unlucky enough to come across a Bowser cookie, Nintendo is also issuing an official challenge — kind of like a real-life minigame: on the rim of a glass of milk, stack as many hero cookies (Mario, Luigi, etc.) as possible on top of a Bowser cookie until he’s defeated (or, rather, falls in the milk). Fans who record Bowser’s “defeat” and share it on social media with #SuperMarioOREO may even receive a surprise from the brand.

(OK, you could argue that this is sort-of-web2 since participants are supposed to post to social media. But still …)

Community, gamification, and interaction with the brand. It’s all there.

The fundamentals of loyalty programs have not changed. Blockchain just makes it easier for the company to track certain elements in real-time, and for members to flaunt their status.

My only complaints about the cookie promotion boil down to:

-

They didn’t call it Super MariOreo. C’mon, people. It was right there.

-

I really, really don’t think that the Oreos brand needs additional marketing exposure. I am not alone in that thought.

Too soon?

FTX crashed and burned. It’s up to the courts to sort out how much of that was due to criminal behavior rather than stupidity, but the crash and burn is not up for debate.

Instead, the latest FTX debate surrounds the company’s future. Will it be more of an Icarus or a phoenix? A few months after declaring that “the dumpster fire is out,” the transition team has once again raised the idea that the failed crypto exchange could make a comeback.

The Wondery/Bloomberg “Spellcaster” podcast series wrapped up just last week. So I’m getting a bit of a “too soon” vibe on an FTX revival.

Or maybe I’m just being a curmudgeon?

On the one hand, yes, running a crypto exchange can be a profitable and legitimate business.

On the other hand, the trials of the former executive team are still underway. Those could run for years. And then we’ll have the inevitable documentaries, movies, and books about the story. Even the proposed rebranding may not be enough for FTX to ditch all that baggage.

But who knows? I wager some folks will join in because they miss meme-stock vibes …

The wrap-up

This was an issue of Block & Mortar.

Who’s behind Block & Mortar? I'm Q McCallum. I've spent the past two decades in the emerging-tech space. And I'm very interested in web3 use cases.

Credit where it's due. Big thanks to Shane Glynn for reviewing early drafts. Any mistakes that remain are mine.

Reading this online? Or as a forward? Why not sign up? Get Block & Mortar news in your inbox, whenever it's published.

Privacy statement: I don’t share/rent/sell your personal info. Seriously.